Servo motor market status and future development trends

“Servo” is derived from the Greek word for “slave.” In English, “servo” refers to a system that follows external commands to achieve the desired motion, enabling precise control of position, speed, acceleration, and torque.

A “servo motor” can be understood as a motor that absolutely obeys control signals: the rotor remains stationary before the control signal is issued; when the control signal is issued, the rotor immediately rotates; and when the control signal disappears, the rotor stops immediately.

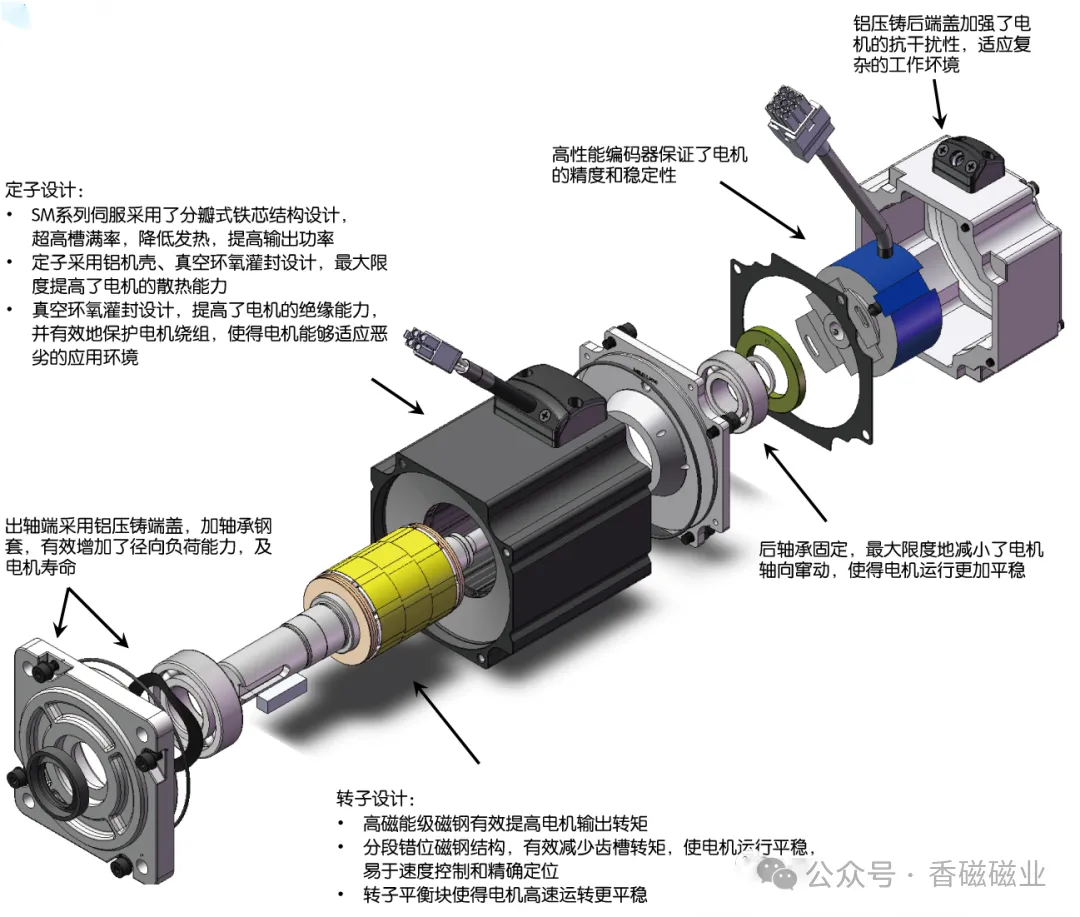

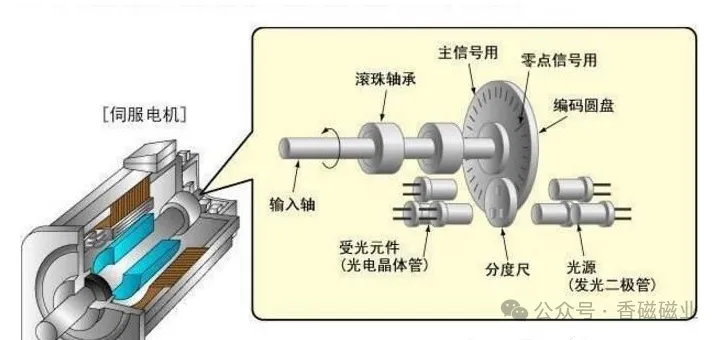

Servo motors are the most widely used motors in the industrial automation industry. They have the advantages of fast response speed, high precision, fast acceleration and deceleration, and speed and load-independent performance. They have a wide speed range, good high-speed performance, smooth operation at low speeds, and strong overload capacity, being able to withstand loads three times the rated torque. They are suitable for applications with instantaneous load fluctuations and fast start-up requirements. A servo motor is a device that can convert electrical energy into mechanical energy. It can precisely control speed and position, with fast response times, and is commonly used in automatic control systems as an essential component. The precision of servo motor control is largely determined by the accuracy of the encoder.

A servo motor is typically composed of two parts: an induction motor and a rotor, also known as a flywheel. When the rotor rotates, it generates an electromagnetic field, driving another small mechanical component called the motor. The rotor has two different coils that are connected to a disc. The disc winds the wires on the rotor, making the entire motor look like a sword. Gear devices ensure smooth rotation of the rotor and also limit noise.

As a core component of industrial automation, the market size of servo motors is steadily growing due to the following factors:

Substitution demand: In fields such as machine tools, textile machinery, printing machinery, and packaging machinery, servo motors have advantages in precision, torque, and overload performance compared to stepper motors, and their penetration rate continues to increase.

New demand: Industries such as industrial robots and electronic intelligent manufacturing equipment have rapidly growing demands for high-precision performance, contributing significantly to the growth of the servo motor market. According to data from Grand View Research and MIR, the global servo motor market size was 36.7 billion yuan in 2020 and is expected to reach 53.9 billion yuan by 2026. China’s servo motor market started relatively late and is still in the growth stage. The market size in China was 14.9 billion yuan in 2020 and is expected to reach 22.5 billion yuan by 2026.

Foreign brands hold a 65% share in the servo motor industry, and the high-end market is basically monopolized by foreign brands. According to MIR data, foreign brands account for 65% of the servo motor competition landscape, while domestic brands account for 35%. According to a report from the Forward Industry Research Institute, mainstream brands can be divided into European, Japanese, and domestic brands. European brands account for 20%, such as Siemens, Lenze, and Bosch Rexroth, which have high overload capacity, good dynamic response, and strong drive openness, but are expensive and have large size and weight. Japanese brands account for 45%, such as Yaskawa, Mitsubishi, and Panasonic, which have relatively low brand performance and prices, small size, light weight, strong reliability and stability, but weaker dynamic response and poor openness, and overall cost-effectiveness. Domestic servo motors account for 35%, such as Delta in Taiwan, Inovance Technology, and Huazhong CNC. These products are basically mature, but their accuracy and reliability are poor, and they are mostly of medium and low power. Mass production of medium and low-end servo systems has been achieved, but the high-end servo systems have not yet formed commercialization and mass production capabilities.

In China, Inovance Technology holds the largest market share at 15.9%, followed by Yaskawa from Japan (11.9%), Delta from Taiwan (8.9%), Panasonic from Japan (8.8%), and Mitsubishi from Japan (8.3%), with a CR5 of 53.8% and a relatively high concentration.

Currently, medium and low-end servo systems in China have achieved mass production, but the high-end servo systems have not yet formed commercialization and mass production capabilities. The demand for precision servo motor control systems in China mainly relies on imports. With the rapid development of the robot industry, the pace of import substitution for servo systems in China will accelerate as support policies for the robot industry are promoted and domestic servo technology continues to improve.